What Developers and Contractors Should Prepare For

The UK construction industry approaches the final quarter of 2025 with cautious optimism, navigating a landscape that is both promising and increasingly complex.

While output is forecast to grow by around 2% this year, this figure only hints at the deeper challenges and opportunities beneath the surface. Growth is being supported by recent interest rate cuts, which have eased borrowing costs, alongside significant investments from both government and private sectors in housing and critical infrastructure.

Developers and contractors continue to face an ever-demanding environment. Supply chains remain fragile following recent international disruptions and limited local production capabilities, putting pressure on material availability and cost. Skilled labour shortages, particularly in specialist trades, continue to strain project delivery, made all the more acute by an ageing workforce and shifting employment expectations.

At the same time, a fast-evolving regulatory framework, focused heavily on sustainability and net-zero carbon targets, is reshaping how buildings are designed and constructed.

Coupled with this is a digital transformation sweeping the industry, with technologies like BIM, AI, and real-time data analytics becoming essential tools, bringing efficiency but also requiring new skills and risk management approaches.

This forecast offers a detailed look at these intertwined trends, providing practical insights to help industry stakeholders meet challenges head-on and seize emerging opportunities throughout Q4 2025 and beyond.

Current Market Outlook and Economic Context

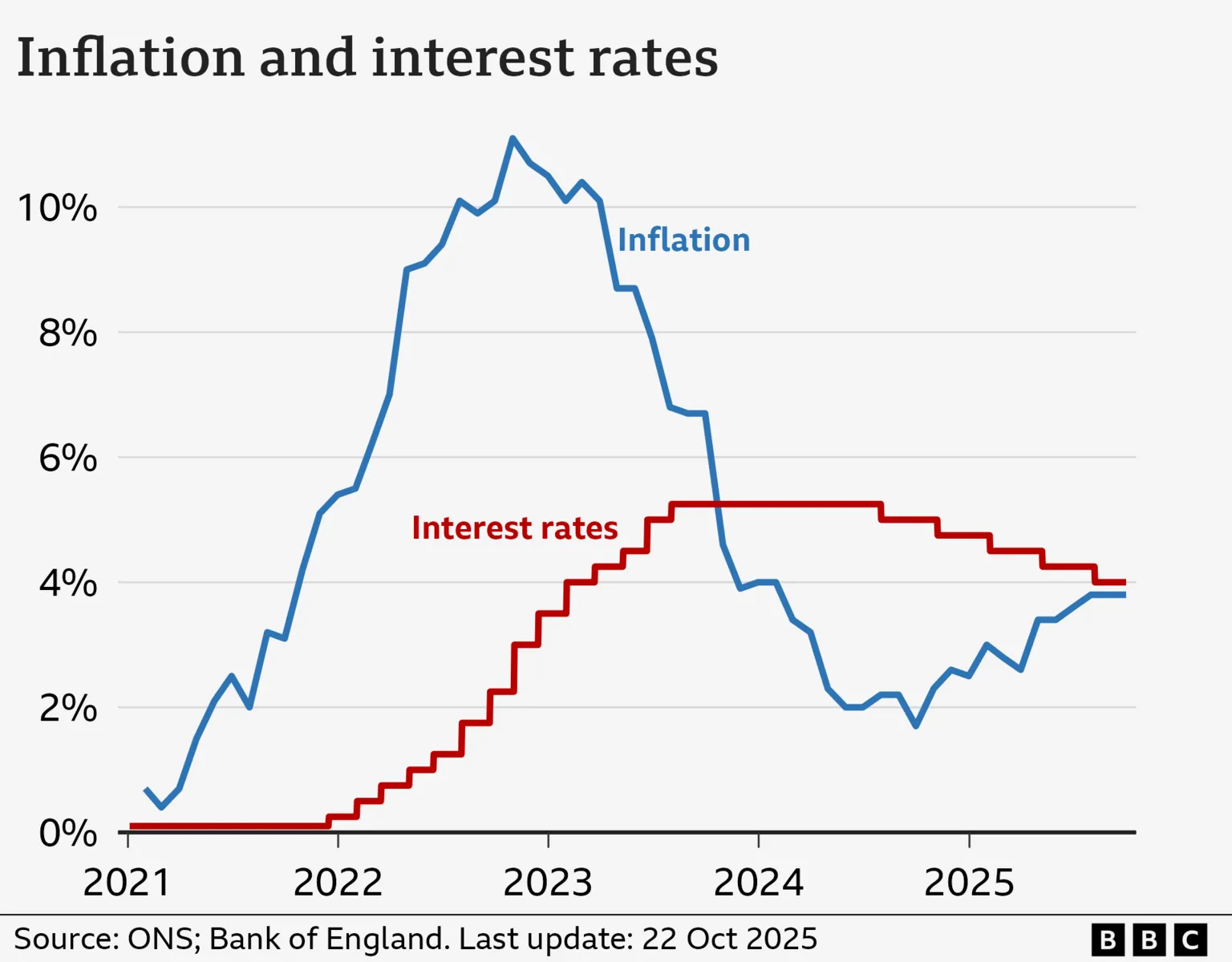

The good news is that the UK construction sector’s output is expected to increase approximately 2% in 2025, according to a recent market analysis by Research And Markets.com. This growth is driven by key macroeconomic factors including a reduction in Bank of England base rates from 4.25% to 4% in August 2025, the fifth rate cut since August 2024.

Lower interest rates have encouraged investment in housing developments and commercial projects, reinvigorating loan disbursements and support from both private and public sectors. Concurrently, insolvency rates in England and Wales have marginally improved, signaling more stable business conditions.

Government investment remains pivotal, especially the GBP 2.6 billion NHS Shared Business Services modular building framework announced in mid-2025.This four-year initiative, which identifies 27 suppliers for next-generation modular construction, aims to accelerate the delivery of essential public infrastructure like hospitals, schools, and social housing at lower costs and reduced disruption.

Additionally, the UK’s ambitious infrastructure plans include ongoing commitments to energy transition projects worth billions annually, underpinning commercial construction demand.

https://www.bbc.com/news/articles/c3dky111m40o

Key Trends Shaping Q4 2025

1. Modular and Offsite Construction Expansion

Modular and offsite construction continue their trajectory from niche innovation towards mainstream adoption, fundamentally reshaping project delivery frameworks. Beyond just speed and cost efficiency, modular approaches mitigate risks associated with increasingly volatile on-site environments, particularly amid skilled labour shortages and tighter health regulations.

The NHS Shared Business Services initiative, valued at GBP 2.6 billion, highlights the public sector’s commitment to these methods, with 27 suppliers onboarded to deliver next-generation modular projects across hospitals, schools, and social housing.

Private developers are following suit, attracted by the potential for repeatable, scalable solutions that drive consistency in quality and delivery. For contractors, this transition requires strategic upskilling and supply chain recalibration, demanding a hybrid model that seamlessly integrates factory precision with onsite adaptability.

2. Persistent Material Shortages and Price Volatility

The aftershocks of global supply chain disruptions continue to reverberate, with critical materials like bricks emblematic of systemic bottlenecks.

UK domestic production capacity remains constrained due to historic underinvestment and workforce attrition during the pandemic and Brexit adjustments. The manufacturing lead time for premium bricks, for example, stretches as long as ten weeks, causing delays in project schedules.

Compounding these challenges are inflationary pressures in metals and energy markets, where costs remain above long-term averages despite some recent price easing. Steel prices are somewhat more favourable but remain elevated overall.

Developers and contractors must thus adopt proactive procurement strategies: diversifying supplier bases, entering into forward contracts where feasible, and incorporating more accurate cost contingencies into project bids.

3. Skilled Labour Shortages and Capacity Constraints

Labour market limitations remain one of the sector’s most persistent and multifaceted challenges. Beyond sheer shortages, evolving workforce dynamics including early retirements, shifts toward flexible work, and sector reputational issues, are shaping the available talent pool.

Specialist trades such as mechanical, electrical, and digital construction roles are under particular strain, driving sustained wage inflation that feeds into overall tender price pressures.

Despite some easing in wage growth seen in recent collective bargaining agreements, capacity constraints continue to limit the pace and scale of project completions.

Forward-looking contractors are investing heavily in training and retention programmes, augmented by automation and productivity-enhancing technologies that help optimise scarce workforce resources.

4. Regulatory and Compliance Landscape

The regulatory framework governing UK construction is undergoing substantial change, propelled by ambitious climate targets and heightened safety concerns.

Amendments to Part L of the Building Regulations, requiring sharper energy efficiency standards, demand early design integration to preclude costly retrofits or compliance failures.

Simultaneously, evolving health and safety legislation compels higher standards of onsite risk management, further emphasising the importance of rigorous training and robust systems. Legal compliance for environmental impacts, from waste management to emissions reporting, adds layers of complexity.

Navigating this evolving landscape calls for dynamic risk management approaches and close coordination with regulators to pre-emptively address emerging directives.

5. Sustainability and Net Zero Imperatives

Sustainability is no longer an optional add-on but a core mandate shaping every facet of construction activity. The UK’s goal to reach net zero carbon emissions by 2050 cascades into near-term requirements for low-carbon building materials, circular economy principles, and energy-efficient design.

Government incentives, such as the Green Deal and Enhanced Capital Allowance Scheme, reward innovations that reduce carbon footprints and enhance lifecycle resilience.

Ground-breaking projects incorporating renewable energy integration, biogenic materials, and advanced climate-resilient design elements are becoming exemplars within the industry.

For developers, embedding sustainability early translates not only into compliance but also long-term value creation amid growing regulatory and market scrutiny.

6. Digitalisation and Technological Innovation

The transformational impact of digital technologies accelerates as Building Information Modelling (BIM) matures from digital design to full lifecycle asset management.

Coupled with AI-driven analytics, drones, and IoT-enabled remote monitoring, these tools enhance transparency, minimise errors, and sharpen real-time decision-making.

Cybersecurity emerges as a critical risk vector in this increasingly connected ecosystem, requiring integrated governance frameworks and specialised insurance products.

Embracing these digital resources is becoming essential for contractors wanting to boost productivity, control downtime, and offer differentiating value propositions in an ultra-competitive environment.

7. Rising Construction Costs and Tender Price Inflation

Despite some mixed movement in materials prices, the main driver of inflation in the UK construction sector continues to be pressures in the labour market combined with a risk premium reflecting ongoing uncertainty.

Current estimates suggest tender prices have increased by about 3% during 2025, aligning closely with the UK’s Consumer Price Index (CPI) which has remained steady around 3.8%.

While inflation on materials like steel and timber has eased somewhat in certain categories, overall material costs remain elevated due to supply chain constraints and global energy prices. Energy costs themselves remain stubbornly high, adding further pressure not only on materials manufacturing but also on transport and subcontractor operations.

Specialist subcontractor rates are also holding firm, reflecting capacity constraints and ongoing labour shortages.

In this environment, developers and contractors must become increasingly vigilant in budgeting, incorporating strong contingency allowances to manage these cost fluctuations.

Additionally, there is a growing need to actively explore design optimisation and value engineering strategies that reduce costs without compromising project scope or quality.

Strategic Recommendations for Developers and Contractors

To thrive in Q4 2025, UK construction stakeholders should focus on several strategic priorities:

- Financial Planning and Investment Leveraging: Capitalise on current low interest rates to secure favourable financing for projects. Early financing not only secures better terms but also acts as a hedge against unpredictable cost rises ahead.

- Modular Expertise Development: The future’s modular. Forward-thinking firms are building offsite capabilities now: training teams, retooling supply chains, to unlock faster programmes and reliable quality. Those who wait will be lagging behind the innovators.

- Supply Chain Robustness: The best players diversify suppliers and set up forward buying and stockpiling strategies for critical materials. Building these buffers privately avoids costly delays and shields projects from sudden price shocks.

- Workforce Strategy Enhancement: Recruitment and retention of skilled trades are non-negotiable. Pair this with productivity technologies to do more with less, the double-win that keeps projects on track despite shortages.

- Regulatory Vigilance: Keep an eagle eye on evolving building regulations and environmental mandates. Nipping compliance issues in the bud early saves you from expensive rework and penalties that silently erode margins.

- Sustainability Integration: Embed sustainability not just to tick boxes but to unlock government incentives and appeal to eco-conscious clients. Communicate your green credentials loudly, it’s your competitive edge in today’s market.

- Technology Adoption: Accelerate adoption of BIM, AI, drones, and IoT for superior project oversight, cost reduction, and safety. Those who master technology today will lead tomorrow’s projects.

- Cost Control and Risk Management: No surprises here, tighten your budgeting processes and build robust risk management strategies that factor in material price swings, labour market volatility, and regulatory changes. Preparedness turns risk into opportunity.

Sectoral Outlook by Project Type

- Residential Construction: Recovery in housing starts has gained momentum with a 25% increase as of Q1 2025 compared to mid-2024 lows, supported by improved mortgage availability and buyer interest.

High-density urban developments are rising, though affordability remains a challenge. Developers should innovate to reduce build costs and access modular solutions. - Commercial and Industrial Projects: While private demand is subdued, government-backed infrastructure and institutional projects provide steady workstreams. Flexible workspace and logistics facilities reflect evolving post-pandemic usage trends.

Contractors must balance cautious bidding with focus on efficiency. - Infrastructure and Energy: Energy sector investments, particularly in offshore wind and utilities, drive growth with multi-year projects underway.

Public sector investment in transport infrastructure remains robust, though some delays have moderated near-term growth forecasts.

Key Insights and Strategies for Construction Success in 2025

The UK construction market in Q4 2025 presents a cautiously optimistic scenario, but optimistic nonetheless.

The coming months offer fertile ground for those bold enough to seize the opportunities amid uncertainty. Developers and contractors who proactively adapt, innovate and invest will be the ones who prosper and set the pace for the industry’s future. Those who remain overly cautious or hesitant risk falling behind as the sector undergoes rapid change and fierce competition.

While modest growth of around 2% is forecasted, the reality beneath the surface is complex, involving ongoing supply chain fragility, significant labour shortages, tightening regulations, and rising costs.

The industry’s trajectory is increasingly shaped by sustainability demands, modular construction, and digital transformation, forces that redefine how projects are delivered.

Leaders in 2026 and beyond will be those who smartly use low borrowing costs, build modular skills, strengthen supply chains, secure skilled workers, adapt to regulations, embed sustainability, adopt new tech, and keep tight control on costs and risks.

The construction firms that choose to act decisively and innovate will not only navigate challenges successfully but capture emerging opportunities that fuel long-term growth.

References and Further Reading

- UK Construction Industry Report 2025: ResearchAndMarkets.com

Provides detailed forecasts, sector analysis, and market drivers up to 2029.

Read more - Bank of England Interest Rate Data – Official statistics on historical and current rates, essential for understanding the macroeconomic context.

Read more - UK Construction Market Outlook – Arcadis – Industry insights and workload forecasts for late 2025.

Read more - Glenigan Construction Forecast 2024-2025 – Market forecast report with data on project pipelines and sector challenges.

Read more - When Will interest rates fall again? – BBC News

Explains recent trends and forecasts for UK interest rates, helping contextualise monetary policy impact.

Read more